Whether you're considering investing or trading in securities in Nova Scotia, it's important to know about the Nova Scotia Securities Act. This provincial law provides for the rules that investors, traders, and corporations must follow when it comes to all forms of securities. Compliance with this law allows certain investment activities by regulated entities and prevents liability on industry actors.

What is the Nova Scotia Securities Act?

The regulation of the financial and corporate industry is a shared responsibility among the federal and provincial or territorial governments. However, when it comes to securities regulation, this is mostly governed by the laws enacted in each province and territory.

In Nova Scotia, securities regulation is covered by its Securities Act, which was enacted in 1990 and has been amended several times. Its latest amendments in 2021 include:

- additional rules when reviewing disclosures

- new prohibition on abetting and reprisal

- new rules that the Nova Scotia’s securities regulator can enact

Purpose of securities regulation

In general, Canada’s securities regulation aims to:

- ensure trust and confidence of the public to the financial sector

- define and prosecute offences related to securities and investments

- keep the financial market transparent and fair

What is the Nova Scotia Securities Commission?

Since securities regulation is within the powers of each province and territory, these jurisdictions have their own securities regulator. For Nova Scotia, that would be the Nova Scotia Securities Commission (NSSC). The NSSC and the Act are deeply connected, since the NSSC’s authority, power, and responsibilities are defined under the Act.

Here’s a video that explains more about the NSSC:

If you want to learn more about securities regulation in Canada, consult with the best corporate finance lawyers as ranked by Lexpert.

How are securities regulated in Nova Scotia?

As with the securities and derivatives law of the other Canadian provinces and territories, the Nova Scotia’s Securities Act governs three main areas:

- who are required (and exempt) to be registered with the NSSC

- what are the obligations of these registered entities

- what practices in the trading or selling of securities are allowed

When it comes to your specific concerns on how the Nova Scotia Securities Act works, it’s better to consult with a legal professional, such as a corporate finance lawyer.

Here are some of the basics of the Securities Act of Nova Scotia:

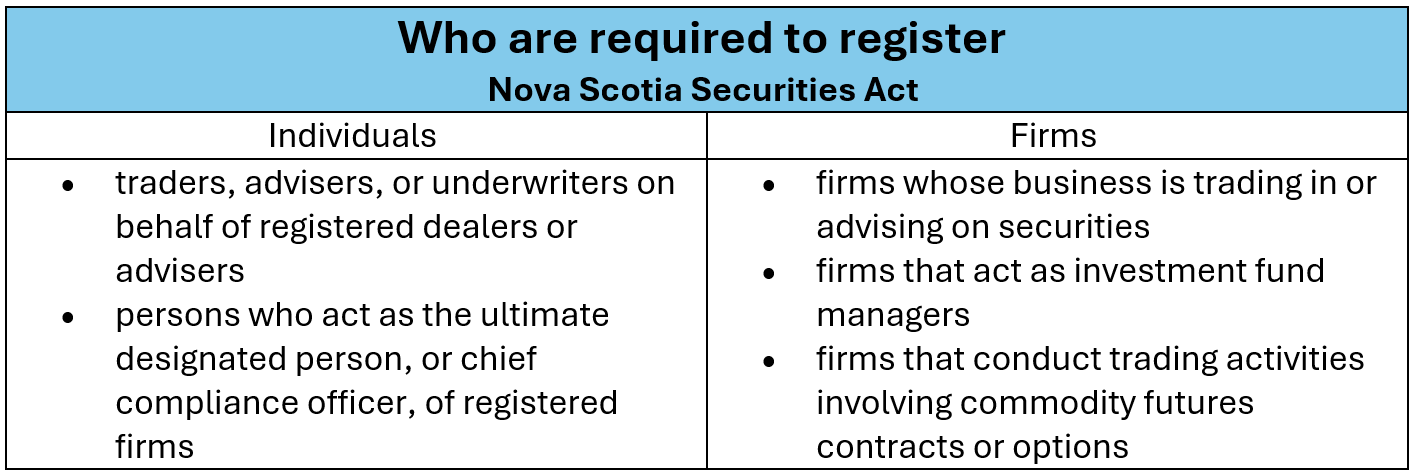

Registration scheme for individuals and firms

Persons and firms that are dealing, handling, and trading securities and derivatives are regulated by the Act and the NSSC in many ways. To start, specific persons are required to be registered with the NSSC before doing any securities-related activity. According to the NSSC, the following individuals and firms are required to be registered with them:

Similarly, the NSSC can revoke any registration on certain legal grounds.

Exempted from the registration scheme

There are certain personalities, both individuals and firms, who are exempt from this registration requirement. Under the Nova Scotia Securities Act, these exceptions are:

- cooperatives: for securities distributed to its member, or to a purchaser who becomes its member after the trade, subject to certain exceptions

- credit unions: for shares of credit unions incorporated and operating under Nova Scotia’s Credit Union Act

However, there are other exemptions found in the regulations enforced by the NSSC, particularly National Instrument 31-103.

Obligations of registrants under the Securities Act

After a person or firm is already registered, the law imposes on them certain obligations. Among them are the following:

Prospectus requirement when distributing securities

The Nova Scotia Securities Act has set up some pre-requisites before securities can be distributed to the public. One of these is the requirement of a registered dealer or trader to file a prospectus with the NSSC, who will then issue a receipt for such filing. After that, the registrant is considered as a reporting issuer.

The Act also requires that this prospectus disclose all material facts related to the securities being issued. This prospectus must also be sent to the purchaser before an agreement between them and the reporting issuer is made.

Obligations of reporting issuers

Also called continuous disclosure obligations, reporting issuers are required to regularly file certain reports with the NSSC. These will ensure that the public is informed of what is happening to the reporting issuer — financially and organization-wise.

According to the NSSC, these reports include:

- annual or quarterly financial statements

- annual information reports

- business acquisition reports

- material change reports

The NSSC reviews these reports and will inform the issuer of any deficiencies for their compliance.

Regulated transactions related to investments

Although not entirely illegal, there are certain transactions by corporations that are heavily regulated by the Nova Scotia Securities Act and the NSSC, such as:

- take-over bids: requires adequate disclosure, sufficient time to assess the bid, equal treatment of the shareholders of the target company, and minimum tender requirement

- insider trading: occurs illegally when insider reporting as set out in the regulations is not followed by the reporting issuer

When entering these transactions, corporations must follow the Act, as read together with the regulations implemented by the NSSC. For take-over bids, that would be the National Instrument 62-104, while insider trading is regulated by the National Instrument 55-104.

Prohibited conduct under the Securities Act

When trading securities or investments, there are acts that are entirely illegal under the Nova Scotia Securities Act. These include fraudulent schemes, misrepresentations, and other unfair practices. Penalties for these offences include administrative fines, civil liability, and/or imprisonment.

Looking for more details on the Nova Scotia Securities Act? Reach out to any of the Lexpert-ranked best corporate finance lawyers in Nova Scotia.

Related Articles: