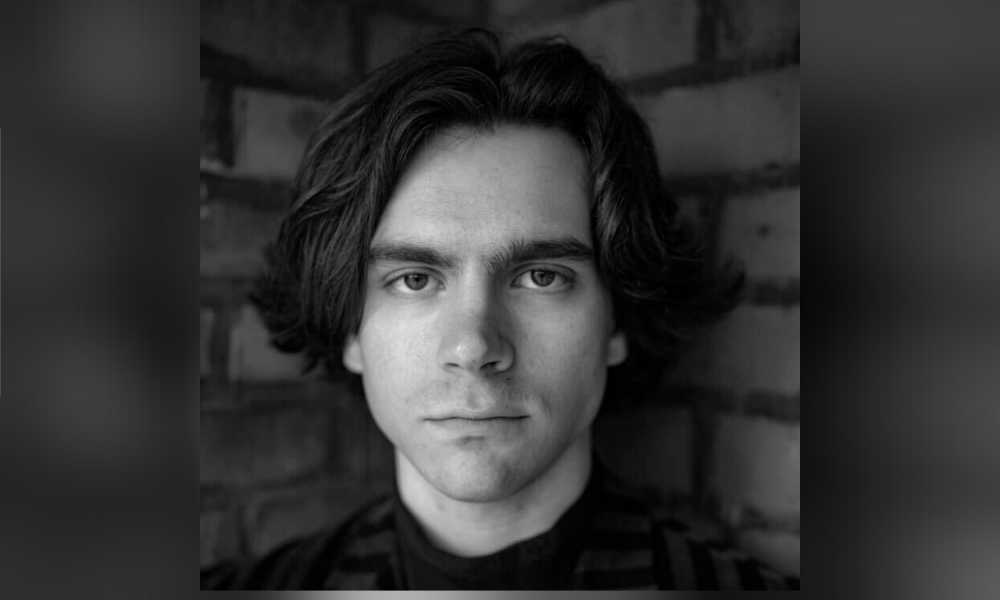

Early in his career, Gregory Joffe knew he didn’t want to remain in private practice. His ambition was to combine legal work with a business approach. After articling, he worked in renewable energy consulting and met Instar Asset Management CEO Gregory Smith. Joffe joined the company in 2013.

As general counsel, Joffe thrives on understanding the drivers behind business decisions, a perspective he says many lawyers often miss when they are brought in later to draft an agreement. The thrill for Joffe lies in understanding why certain decisions are made, sitting down with the other side, and creating a structure that works for both parties. “We have to decide what we want to draft first,” he explains.

Joffe’s legal expertise has been central in several high-profile transactions, with one of the most notable being the acquisition of the passenger terminal at Billy Bishop Airport in Toronto. “We acquired the terminal from Porter,” Joffe recalls, explaining how Instar led a consortium that included JP Morgan, Partners Group, and the Kilmer Group to secure the deal. The project stands out for Joffe for its scale and the complex legal and commercial negotiations. Another standout transaction is Instar’s recent partnership with Fontainebleau Aviation, where they invested in the luxury brand’s fixed-base operator (FBO) in Miami and FBO development project in Fort Lauderdale. Joffe’s ability to navigate these multi-faceted deals, blending legal knowledge with commercial strategy, has been a hallmark of his work.

Regarding the challenges facing the private equity industry, particularly in infrastructure, Joffe is acutely aware of the changing market dynamics. “Macroeconomic conditions have affected the climate for dealmaking, with a pivot away from momentum investing and greater focus on long-term value creation,” he says. For Joffe, the key lies in value investing – finding the right companies with a dominant market position and the ability to adapt to evolving societal needs and stakeholder demands. “That's what infrastructure is, providing those essential businesses and solutions to communities and customers.” It’s a strategy that requires patience and a long-term vision, which are integral to Instar’s approach.

One of the areas where Joffe has had to be particularly vigilant is in adapting to regulatory changes, primarily environmental, social, and governance (ESG) concerns. “At every quarterly board meeting, ESG is on the agenda,” he says.

Instar operates a European parallel fund, which means they’ve had to meet European standards around transparency and ESG for years. Joffe cites the European sustainability-related disclosure in the financial services sector (SFDR) standards as a significant consideration at Instar.

ESG has always been embedded in Instar’s investment approach, particularly in infrastructure, where long-term value creation is tied to community, environmental, and governance considerations. However, he says these regulations haven’t fundamentally altered Instar’s investment strategy, just its reporting and disclosure requirements.

Joffe notes that while European regulations are stringent, Canada is close behind. However, Canadian investors don’t demand the same level of regulatory compliance, even though they value ESG initiatives. Still, Canada’s infrastructure investment landscape is evolving, emphasizing the security of essential services like water and food safety. Joffe believes the private sector will have to step in where governments cannot, creating significant opportunities for private equity in Canada. “The governments don't have the money... they will need to work with private business and private equity to meet current needs and build for the future.” He says Canada is a leader in infrastructure investing globally “without a doubt.”

When it comes to working with external legal teams, Joffe places a strong emphasis on partnership and long-term relationships. For Joffe, the key to these relationships is consistency – working with the same people over time to build trust and ensure everyone is aligned on strategy and objectives. “We've worked with the same lawyers for the last 10 years,” he says. This continuity, Joffe believes, is essential for navigating complex transactions and ensuring that legal advisors understand Instar’s broader business goals.

Looking ahead, Joffe sees significant opportunities for private equity, particularly in mid-market infrastructure projects that cater to essential services. “If you look at infrastructure 10-15 years ago, it was roads and ports. Now, the traditional understanding of infrastructure has shifted to become less about the physical structure and more about the people it serves, including essential businesses addressing public concerns such as water and food safety and security,” he says. Joffe believes the most value can be created in sectors that directly impact citizens’ everyday lives. “It's focusing on that end customer, which is the citizens, you and I, and what we actually need.”