The Canadian Securities Administrators (“CSA”) have released their annual review of disclosure regarding women on boards and in executive officer positions at Toronto Stock Exchange-listed issuers, showing positive trends in the growth of women’s representation over the last nine years. Data from Innovation, Science and Economic Development Canada (“ISED Canada”) on public issuers incorporated under the Canada Business Corporations Act (“CBCA”) and our data on S&P/TSX 60 constituents have also shown progress with respect to the representation of women, although significant gaps remain for members of other diverse groups.

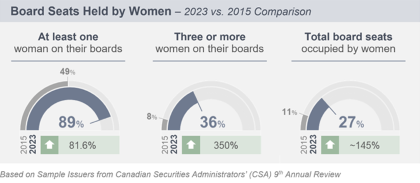

- CSA data shows that, between 2015 and 2023, the percentage of board seats occupied by women has more than doubled, from 11% to 27%; however, there has been slower growth in terms of the percentage of board chairs who are women, from 5% in 2019 to 8% in 2023.

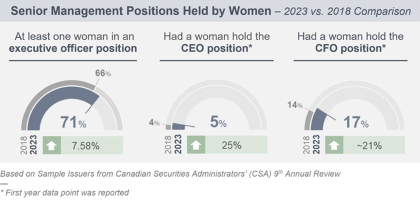

- According to CSA data, issuers with a woman chief executive officer (“CEO”) have remained stagnant at 5% from 2020 to 2023, and issuers with a woman chief financial officer (“CFO”) have decreased by 2% from last year, to 17% in 2023.

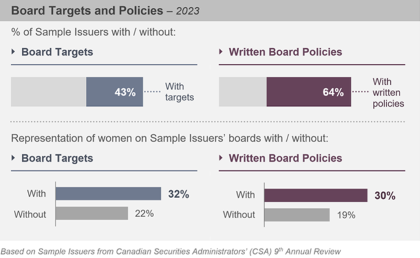

- The majority of issuers reviewed by the CSA (64%) have adopted a written policy relating to the representation of women on their board, with 43% of issuers adopting targets for the representation of women on their board and 5% adopting targets for representation in executive officer positions; however, only 34% of distributing corporations reviewed by ISED Canada had adopted a written policy with respect to the representation of women on boards.

The Reviews

On October 5, 2023, the CSA published CSA Multilateral Staff Notice 58-316 Review of Disclosure regarding Women on Boards and in Executive Officer Positions (Year 9 Report) (the “CSA Review”). This marked the ninth annual review by the CSA of issuers that were subject to the disclosure requirements of National Instrument 58-101 Disclosure of Corporate Governance Practices (“NI 58-101”) and Form 58-101F1 Corporate Governance Disclosure (“Form 58-101F1”). (For more information about NI 58-101, please see our previous discussion of this topic.) The results summarized disclosures from 602 issuers listed on the Toronto Stock Exchange (“TSX”) that had year-ends between December 31, 2022, and March 31, 2023, and filed information circulars or annual information forms by July 31, 2023.

ISED Canada has also released its third annual report (the “CBCA Review”), which looked at the diversity disclosures of 498 issuers. The CBCA diversity disclosure requirements apply to all “distributing corporations” incorporated under the CBCA, which include those listed on the TSX as well as those listed on other stock exchanges, such as the TSX Venture Exchange, the Canadian Stock Exchange or other foreign stock exchanges, and address more facets of diversity, including women, visible minorities, Indigenous persons and persons with disabilities.

Since 2016, Stikeman Elliott has also been tracking various corporate governance topics, including gender diversity on boards and in executive officer positions at S&P/TSX 60 constituents.

Progress Made

In terms of total board seats held by women, the CSA Review shows a positive trend, from 11% in 2015 to 27% in 2023, an overall 145% increase.

However, in terms of representation of women in senior management positions, the growth rate has been much slower over the past five years.

- 71% of issuers have at least one woman in an executive officer position, an increase of approximately 8% from 2018.

- Only 5% of issuers had a woman CEO, as compared to 4% in 2018. Since 2020, this figure has been stagnant at 5% each year.

- 17% of issuers had a woman CFO. Although this is an overall 21% change since 2018, this figure was at 19% last year.

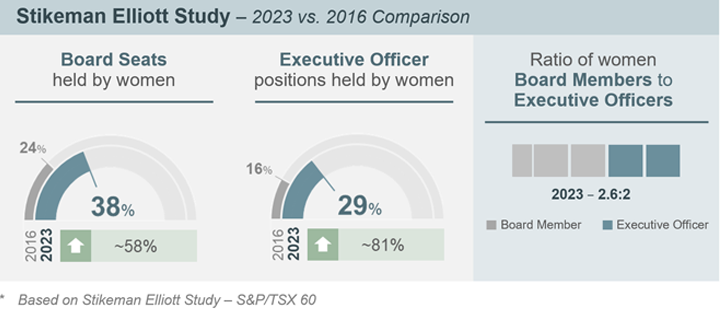

Our data for S&P/TSX 60 constituents comparing 2016 to 2023 shows growth in both the percentage of board seats and executive officer positions held by women. On average, S&P/TSX 60 constituents have 2.6 women board members and 2 women executive officers.

- Board seats held by women: 38%.

- Executive officer positions held by women: 29%.

Once again, the CSA Review found a positive correlation between issuers adopting certain diversity measures and the proportion of board seats held by women. Where issuers had adopted targets for the representation of women on their boards, there was a greater percentage of women on their boards (32%) as compared to issuers without board targets (22%). Another diversity measure that showed a similar correlation was the adoption of written board policies. Issuers with written board policies had a greater proportion of women on their boards (30%) than issuers without written board policies (19%).

The CSA Review also shows that 23% of the issuers that were reviewed had adopted director term limits. From this group of issuers, 33% adopted age limits alone, 31% adopted tenure limits alone and 36% adopted both age and tenure limits. Our tracking shows that 42% of S&P/TSX 60 constituents had director term limits which were, on average, 13 years long, and that age limits on retirement from director positions were adopted by 43% of issuers, at an average age limit of 73 years.

Looking Beyond Gender Diversity

We also track progress in other facets of diversity beyond gender, including the representation of visible minorities, Indigenous persons and persons with disabilities on boards. In 2023, on average, the boards of the S&P/TSX 60 constituents were composed of 1% Indigenous persons, 10% visible minorities and 0.72% persons with disabilities. The CBCA Review also looks at these facets of diversity, and its sample issuers’ boards were made up of 0.6% Indigenous persons, 6% visible minorities and 0.4% persons with disabilities. The CSA are currently proposing amendments to corporate governance disclosure rules, which include changes to board and executive diversity disclosures. One of the proposed options would require an issuer to disclose its approach to diversity in respect of the board and executive officers but would not mandate disclosure in respect of any specific groups other than women. A second, more prescriptive approach that is being proposed would require reporting on the representation of five designated groups, being women, Indigenous peoples, racialized persons, persons with disabilities and LGBTQ2SI+ persons, on boards and in executive officer positions.

For more information, please see CSA Notice and Request for Comment: Proposed Amendments to Form 58-101F1 Corporate Governance Disclosure of National Instrument 58-101 Disclosure of Corporate Governance Practices and Proposed Changes to National Policy 58-201 Corporate Governance Guidelines, which describes the proposed amendments. For some of our previous discussion of board and executive diversity, please see:

- More Women Are Sitting on Canadian Boards But Where Are the Women CEOs and Chairs? (December 7, 2021);

- Are More Women in Canadian Boardrooms? Sixth Annual CSA Review Now Supplemented by First Ever Reporting Under CBCA Amendments (April 20, 2021); and

- ISS Governance Announces Proposed Benchmark Policy Changes for 2024 (November 23, 2023).

***

Raman Grewal is a partner in the Corporate Group and a member of the firm’s Partnership Board. She practises principally in corporate finance and mergers and acquisitions, having expertise on a wide range of matters including domestic and international securities offerings, corporate governance and securities regulatory compliance.

Raman Grewal is a partner in the Corporate Group and a member of the firm’s Partnership Board. She practises principally in corporate finance and mergers and acquisitions, having expertise on a wide range of matters including domestic and international securities offerings, corporate governance and securities regulatory compliance.

She has counselled Canadian and international issuers and underwriters on a wide range of capital markets transactions and securities regulatory matters, including boards of directors, public and private issuers, dealers, advisers, investment funds and asset managers. She also advises on capital market infrastructure and compliance, including fintech and other capital markets developments.

Raman has been recognized by Chambers Global 2024 as a leading lawyer in Capital Markets: Debt & Equity, in Chambers Fintech 2024 as a leading lawyer in Fintech legal, and in the Legal 500 Canada 2024 as a Leading Individual in Capital Markets.

***

J.R. Laffin is a partner and the Co-Head of the Capital Markets and Public Mergers & Acquisitions Group. His practice focuses on securities and corporate law, with a particular emphasis on public mergers and acquisitions, corporate governance, shareholder activism, private equity and corporate finance transactions. He has acted for issuers, private equity funds, boards of directors, special committees, and other transaction participants in numerous M&A transactions, including both friendly and hostile transactions. He also regularly provides advice on corporate governance, general corporate and securities regulatory compliance and exemptive relief matters to various clients, including Canadian and international corporations across a broad range of industries.

J.R. Laffin is a partner and the Co-Head of the Capital Markets and Public Mergers & Acquisitions Group. His practice focuses on securities and corporate law, with a particular emphasis on public mergers and acquisitions, corporate governance, shareholder activism, private equity and corporate finance transactions. He has acted for issuers, private equity funds, boards of directors, special committees, and other transaction participants in numerous M&A transactions, including both friendly and hostile transactions. He also regularly provides advice on corporate governance, general corporate and securities regulatory compliance and exemptive relief matters to various clients, including Canadian and international corporations across a broad range of industries.

J.R. is a leading M&A lawyer and has been recognized for his impressive corporate expertise by the most prominent legal directories, including the International Financial Law Review's IFLR1000: The Guide to the World's Leading Financial Law Firms 2022 as Highly Regarded in Mergers & Acquisitions, and The Canadian Legal Lexpert Directory 2023 as a leading lawyer in Mergers & Acquisitions, Corporate Finance & Securities, and Private Equity. Most recently, and for the second year in a row, J.R. has been named as a Top 10 M&A Lawyer in Canada by MergerLinks.